Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Diperbarui • 2022-12-15

China may respond to US House Speaker Nancy Pelosi's visit to Taiwan with military provocations, including firing missiles near Taiwan or large-scale air or naval activities. Taiwanese and US media say Pelosi plans to visit Taipei on Tuesday night, but there’s no official confirmation. However, responding to reporter questions on Tuesday, Taiwan's Premier Su Tseng-chang said the island "warmly welcomes" any foreign guests. He added that Taiwan "would make the most appropriate arrangements" for visitors.

China's leader Xi Jinping believes in the correctness of the principle of a "united China." According to his beliefs, Taiwan historically belonged to China, so it must be returned in any way.

However, it’s not the only reason. Taiwan's electronics sector attracts the most significant share of foreign investment. Indeed, Taiwan's significance to the global semiconductor industry cannot be understated. Taiwan Semiconductor Manufacturing Company (TSMC) is the world's largest contract chip manufacturer and Asia's most valuable listed company at $600 billion. Much of the world's global semiconductor supply chain relies on Taiwan.

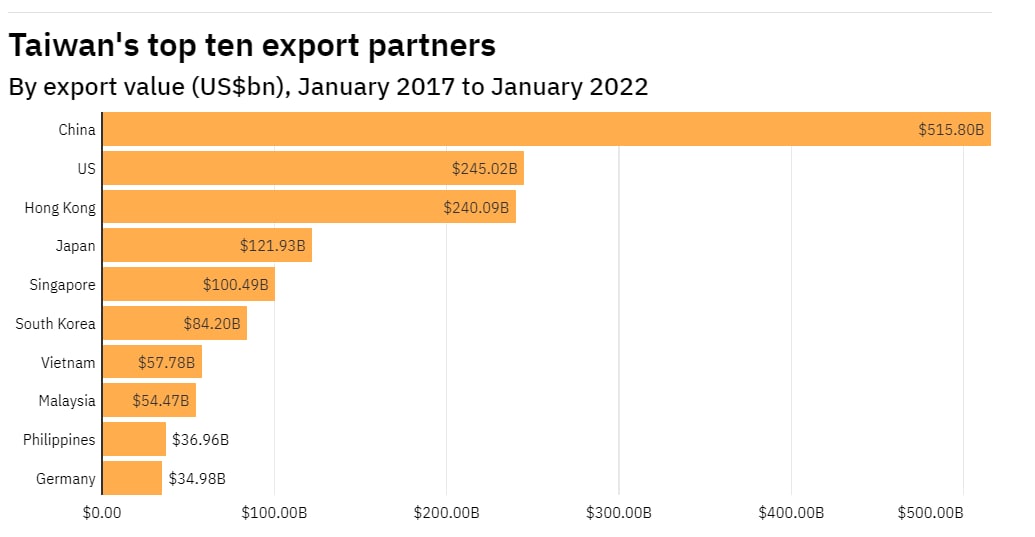

Taiwanese exports across the strait to mainland China were at an all-time high in 2021, but perhaps more importantly, the small island nation has China in a chokehold over semiconductors. In 2020, China spent more on importing chips than it did oil (many experts believe China is stockpiling chips).

There’s a risk that any Chinese invasion of Taiwan would damage or destroy much of the tech infrastructure China relies on to feed its electronics and manufacturing industries with crucial components. The invasion might make Taiwan's semiconductor industry the spoils of war, but, equally, the Taiwanese might be ready to destroy semiconductor plants themselves, most notably TSMC's network of advanced factories, to deprive the Chinese of some of those spoils.

Moreover, it’s questionable whether the Chinese could operate the fabs without the cooperation of the world-beating TSMC team of managers, researchers, and engineers, at least for a few years.

XAUUSD, weekly

Gold will break above $1785 and fly towards $1830 on escalation.

US dollar, daily

US dollar bounced off the local support of 105.00, and the uptrend is still valid. Any escalation will push the greenback’s index to 110.00, pressing other currencies down versus the USD.

Do you want to get updates Live? Subscribe to the @FBSAnalytics Telegram Channel where I post more daily trade ideas!

Pasar saham Asia sebagian besar libur untuk Jumat Agung pada perdagangan Jumat (29/03/2024). Dolar AS juga menguat terhadap euro sebelum data inflasi utama AS

Dolar Australia menguat tipis di awal perdagangan akhir pekan ini, namun masih dalam tren penurunan. Pasar diperkirakan sepi karena memperingati Jumat Agung. Dolar AS menguat karena data ekonomi AS menunjukkan ekspansi,

Pasar saham Asia memiliki sentimen sideways dengan bias bearish pada perdagangan Kamis (28/03/2024), karena adanya sentimen ketidakpastian menjelang data indeks harga PCE AS..penjualan ritel Australia dirilis lebih kecil dari perkiraannya.

Yen Jepang gagal memikat para investor pada perdagangan Selasa (02/04/2024) meski ada peluang atas kemungkinan intervensi dan..Sentimen penghindaran risiko masih berpotensi memberikan kekuatan pada safe-haven

XAUUSD naik ke rekor tertinggi baru pada perdagangan Senin (01/04/2024), di tengah meningkatnya spekulasi penurunan suku bunga..melanjutkan kenaikan kuat minggu lalu hingga membentuk level puncak baru sepanjang masa

Pasar saham Asia sebagian masih libur dan sebagian lagi menguat pada perdagangan Senin (01/04/2024), karena optimisme data pabrikan Tiongkok mendukung..potensi intervensi otoritas Jepang terhadap yen Jepang diperkirakan berada di zona 152 – 155 yen.

FBS menyimpan catatan data Anda untuk menjalankan website ini. Dengan menekan tombol "Setuju", Anda menyetujui kebijakan Privasi kami.

Permintaan Anda diterima.

Manajer kami akan menghubungi Anda

Permintaan panggilan balik berikutnya untuk nomor telepon ini

akan tersedia setelah

Jika Anda memiliki masalah mendesak, silakan hubungi kami melalui

Live chat

Internal error. Silahkan coba lagi

Jangan buang waktu Anda – tetap awasi dampak NFP terhadap dolar dan raup profitnya!