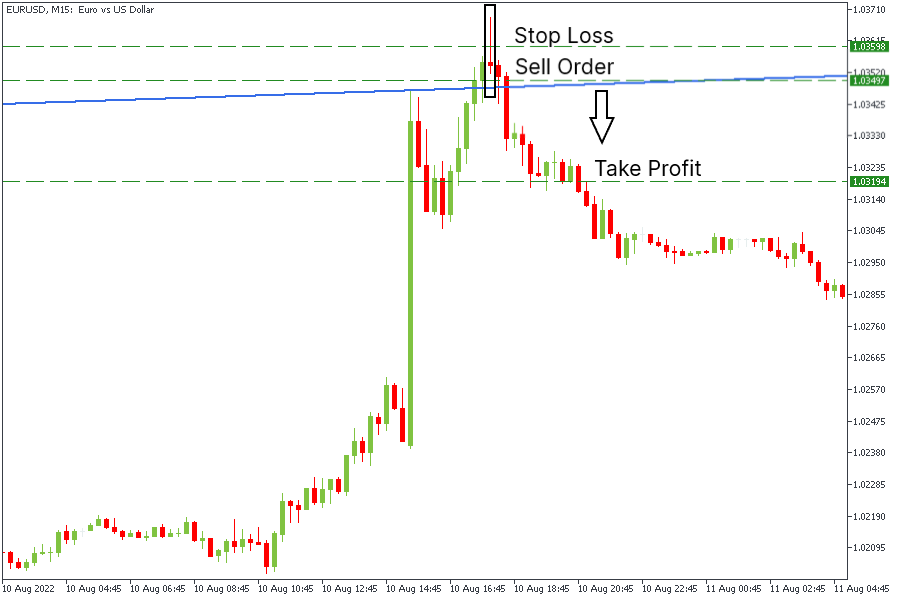

Sometimes a chart or a candlestick pattern may provide a decent entry signal if it is located at a certain level. A pin bar is one of the most reliable and famous candlestick patterns, and when traders see it on the chart, they expect the price to change its direction soon. If you understand how to recognize this pattern and use it in trading strategies, it will serve as an excellent instrument for making reasonable decisions.

What is a pin bar?

A pin bar is a type of candlestick that signals the reversal of prices. It consists of a long shadow, a small shadow, and a body between them. Fun fact: this pattern’s name is short for Pinocchio, as it has a long wick similar to Pinocchio’s nose.

However, besides a long shadow, there are also special market conditions to call a candlestick pattern a pin bar.

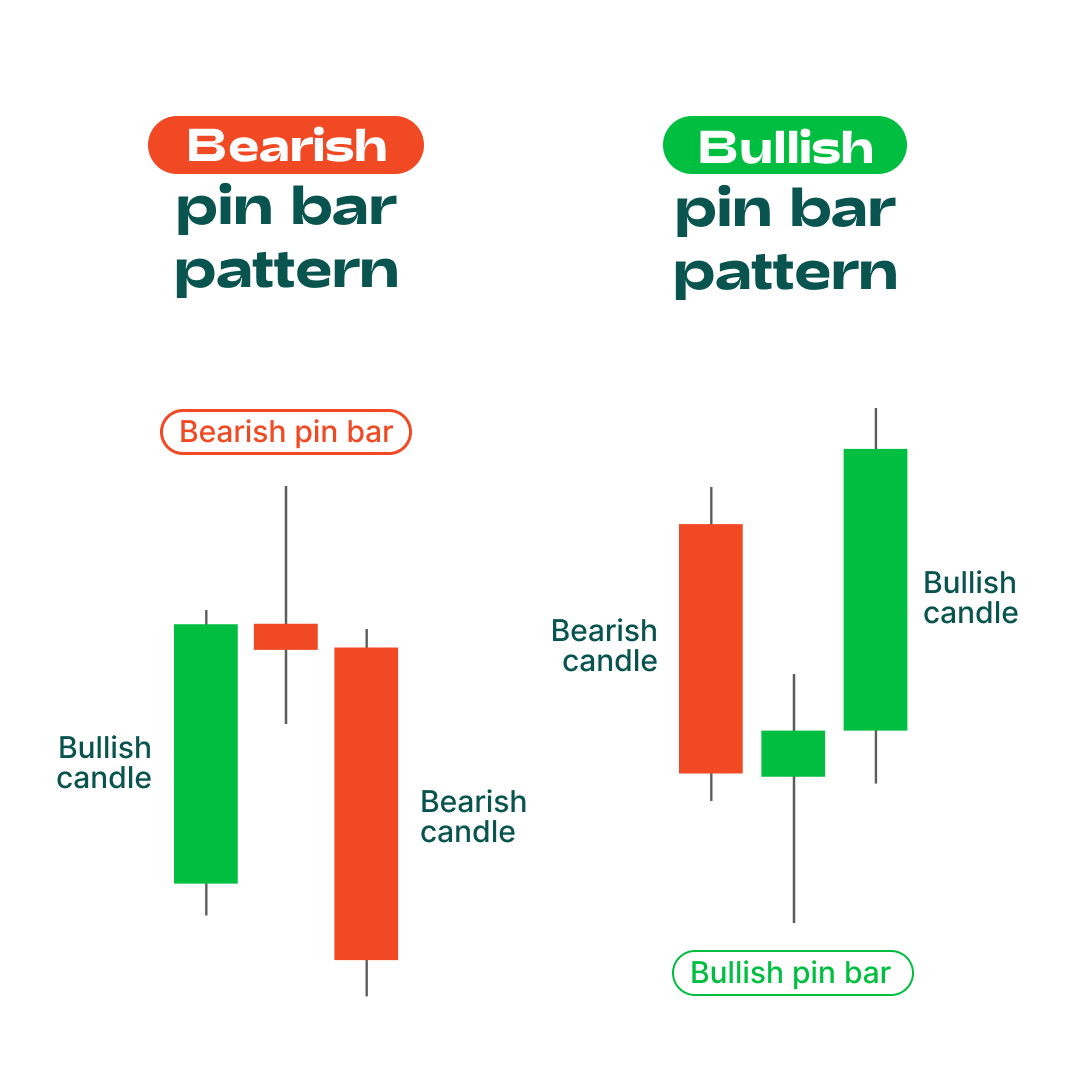

In the picture above, you can see two types of pin bars: bearish and bullish.

A bearish pin bar is formed after a solid movement upwards or at the end of an uptrend. Its body is entirely contained within the body of a previous bullish bar. It has a long upper tail that could be three or more times longer than the body size. It can be either bearish or bullish, but the bearish one is believed to provide a stronger signal. The pattern should be confirmed by the bearish candle that opens below the body of the pin bar. This signal shows that bulls tried to push the price higher, but their attempts got rejected.

A bullish pin bar appears at the end of the downward movement or downtrend. It opens within the body of the previous bearish candlestick and has a long lower tail and a small body. The pattern must be confirmed by the bullish candlestick that opens above the closing price of the pin bar.

Now, as you know the main element of the strategy, let’s move on to the setups.