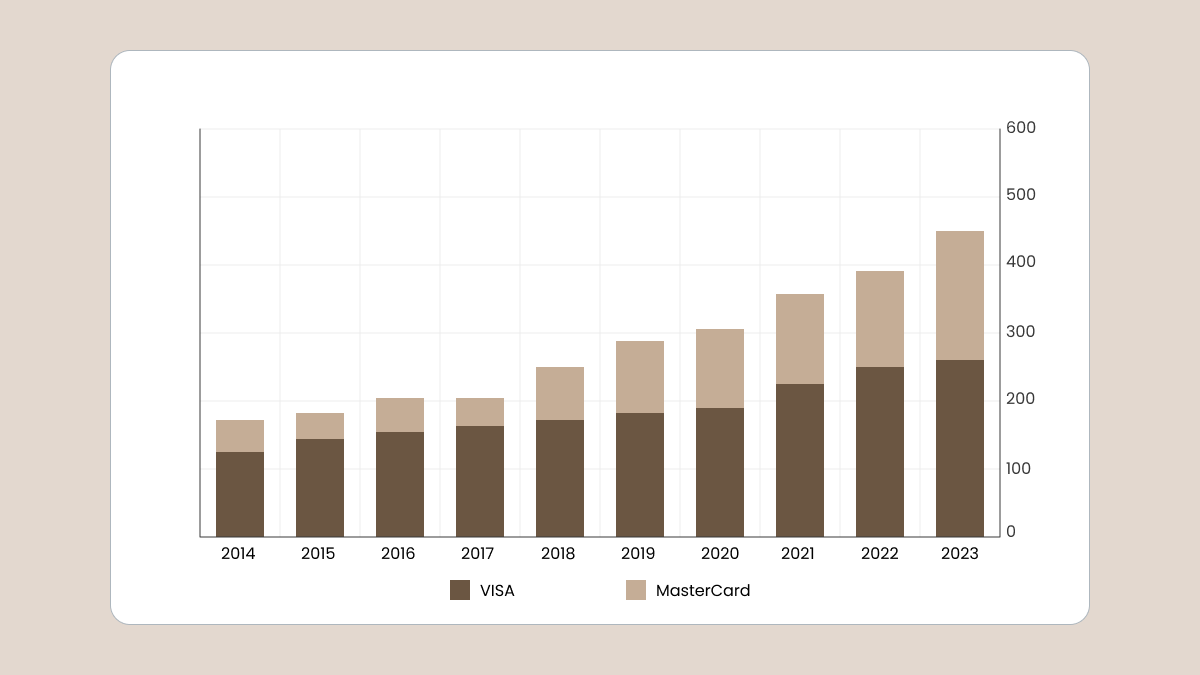

Visa vs. MasterCard: benefits comparison

Both payment processors offer a great variety of benefits. Let’s compare some of them.

Emergency services

There are services that both systems provide.

-

Emergency cash loan. If your card is lost, stolen, or you just don’t have it with you, you can still withdraw money. Usually, whether you are abroad or in your home country, you can get money by calling the processor’s contact center.

-

Lost or stolen card reporting. Contact the network and make sure no one gets access to your money.

-

Emergency card replacement. Get a replacement card within 7 days.

-

Travel and emergency assistance services. Get assistance in an emergency situation. Note that the payment system doesn’t pay for any services, goods, or aid.

Only Visa offers pay-per-use roadside assistance. Roadside dispatch ensures that help is available whenever and wherever you need it while traveling. If your car breaks down, you get locked out, or your tire is flat, you can call the hotline and get help. The program provides a variety of services: tire changing, fuel delivery, towing, jump-starting, and more.

Travel benefits

Both options make an excellent travel card. Here are some of the perks they offer for travelers.

Travel benefits depend on the tier. For example, airport concierge access, hotel stay, and lowest rate guarantees, as well as rental car insurance and basic global services, come with the World MasterCard.

Visa offers discounts at selected hotels and a rental car collision damage waiver at the Traditional tier. All this, plus travel and emergency assistance services, built-in auto rental coverage, global entry statement credit, luxury hotels, and airport lounge access comes with an Infinite card.

Purchase protection and insurance

When it comes to purchase protection and security, Visa leaves MasterCard behind.

There are services that both provide.

-

Zero liability fraud protection. If someone steals your credit card details or makes a purchase without your permission, you won’t have to pay for it.

-

Cell phone protection.

-

MasterCard ID theft protection or ID Navigator powered by LifeLock (Visa). It offers such features as dark web monitoring, data breach notifications, and privacy monitoring to help prevent identity theft.

A Visa card gives you more safety features and opportunities.

-

Lost luggage, trip or baggage delay, and trip cancellation reimbursement.

-

Extended warranty protection.

-

Airline incidental fees.

-

Travel accident insurance.

-

Hotel theft protection.

-

Price protection.

-

Emergency evacuation.

-

Return protection.

-

Purchase security.

Don’t worry about the security of your deposits and withdrawals at FBS. Security is our priority. Start now!

FAQ

Which is better: Visa or MasterCard?

To choose a credit card, you should focus on your priorities. Decide what advantages are important to you.

Both companies offer extra benefits, especially related to travel and shopping. These can help you if your flight gets canceled, or you can get a refund for damaged items. The specific perks and protections can be different depending on the card, so make sure to check what’s included with yours. Don’t hesitate to consult the bank that issues the card.

Whether you’re shopping online, traveling, or trading, all of these features make credit cards safe and convenient.

No matter what you decide, you can use either one to make profit with FBS. Open an account, deposit money, and start trading: withdrawal is easy, transactions are secure, and there is a wide range of trading instruments for you.