For the month of August, I have my eyes set on three pairs for my swing trading opportunities during the course of the month. Asides these three, most of my other trade ideas will be executed on lower timeframes, and with more conservative targets in mind. Do note, as always, that these are my personal ideas, and do not serve as a financial advise.

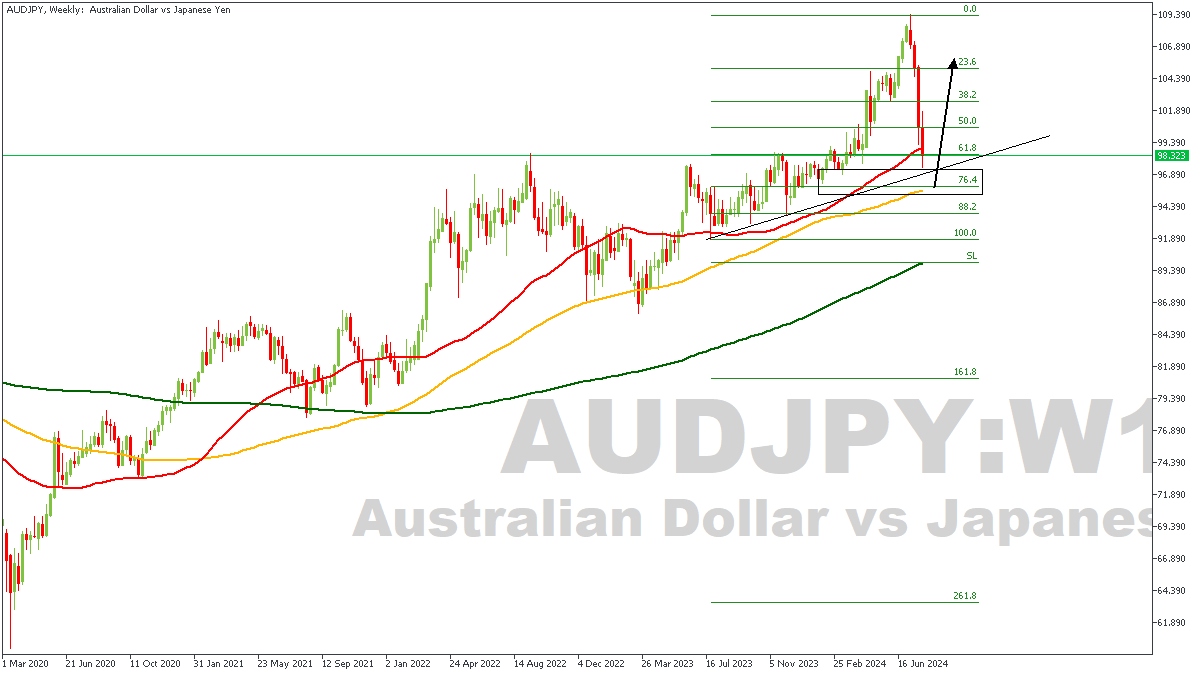

AUDJPY – W1 Timeframe

Without altering or challenging the course of the moving averages and their bullish array, we see price head into the 100-period moving average on the weekly timeframe of AUDJPY as a likely area of support. In line with this, we also see the weekly timeframe demand zone which overlaps the weekly timeframe pivot, and the trendline support that cuts across them both; come within the reach of the price action – implying quite simply that prices may reverse bullish from the area of confluence.

Analyst’s Expectations:

Direction: Bullish

Target: 105.246

Invalidation: 95.165

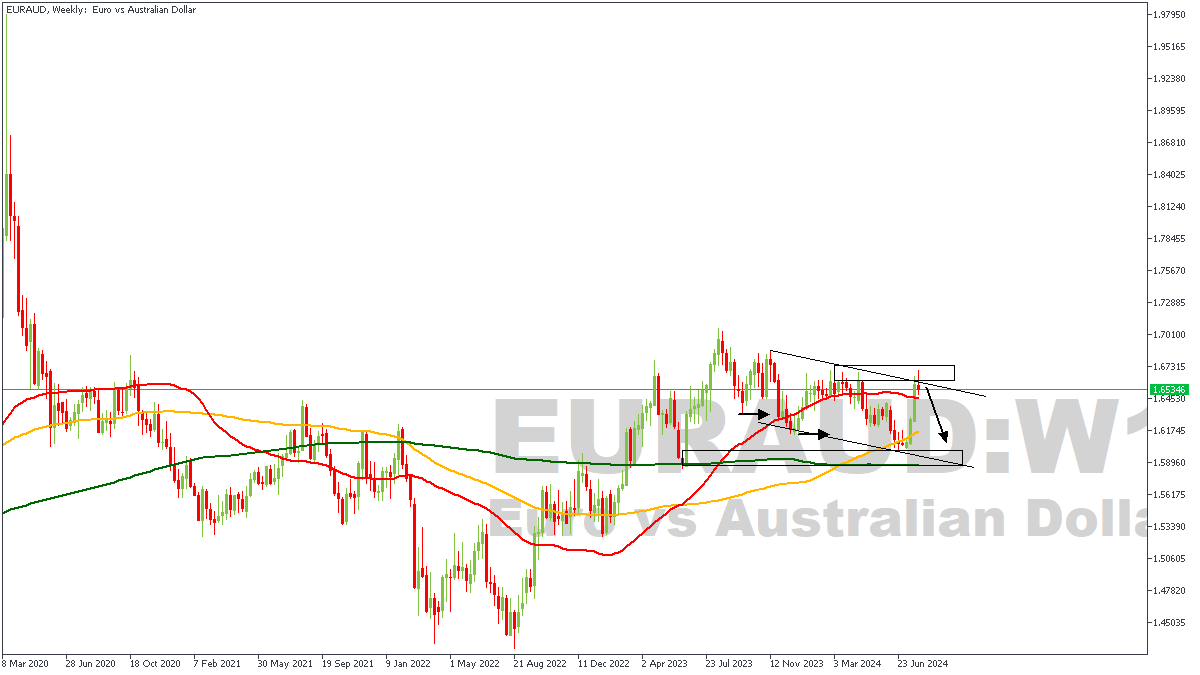

EURAUD – W1 Timeframe

There is a descending channel on the weekly timeframe of EURAUD; which means the outcome could be a breakout, or a formidable rejection. To the left of the current price point, we see price has broken structure downwards a few times in the past, leading me to look for the supply zone responsible for the bearish break of structure. That supply zone, coupled with the trendline resistance, as well as the overbought RSI (Relative Strength Index) are my basis for expecting a bearish outcome from all of this.

Analyst’s Expectations:

Direction: Bearish

Target: 1.62553

Invalidation: 1.68862

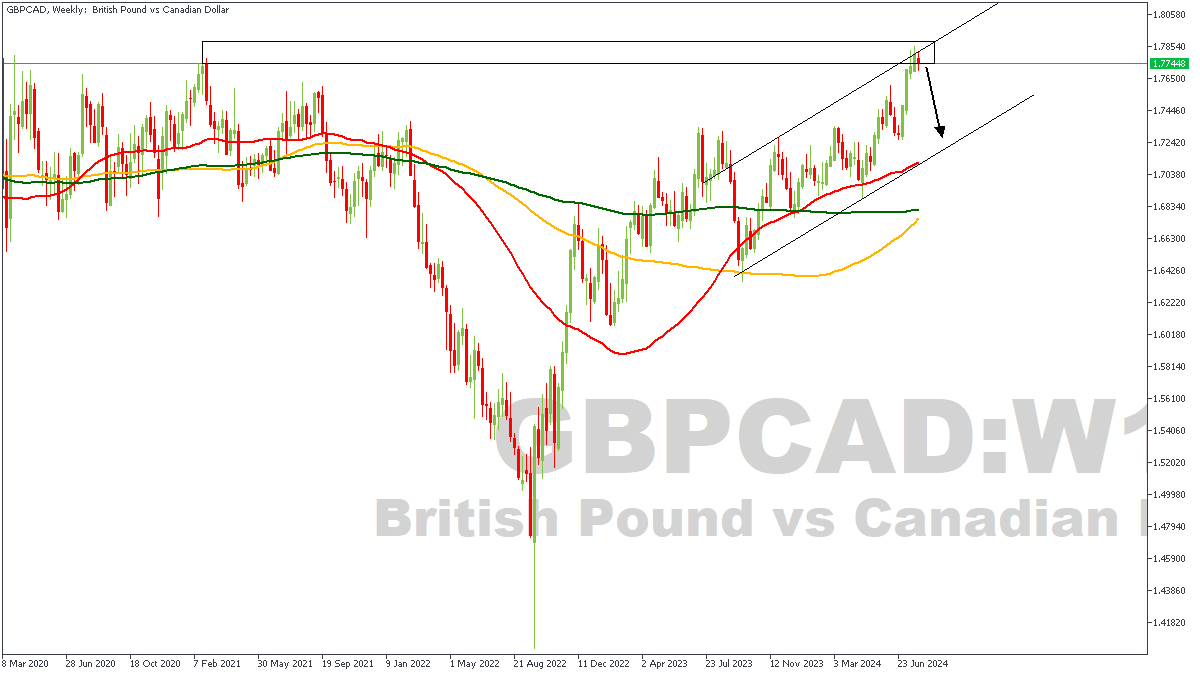

GBPCAD – W1 Timeframe

On the weekly timeframe chart of GBPCAD as shown on the chart, we see price trade into the weekly timeframe supply zone, whilst staying within the confines of a rising channel. Price has initially been rejected off the intersection of the resistance trendline, and the supply zone, and may very well reverse completely from the highlighted zone; albeit, lower timeframes hold the trigger for a bearish scenario.

Analyst’s Expectations:

Direction: Bearish

Target: 1.73661

Invalidation: 1.78949

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.