Why are bullish and bearish flags important?

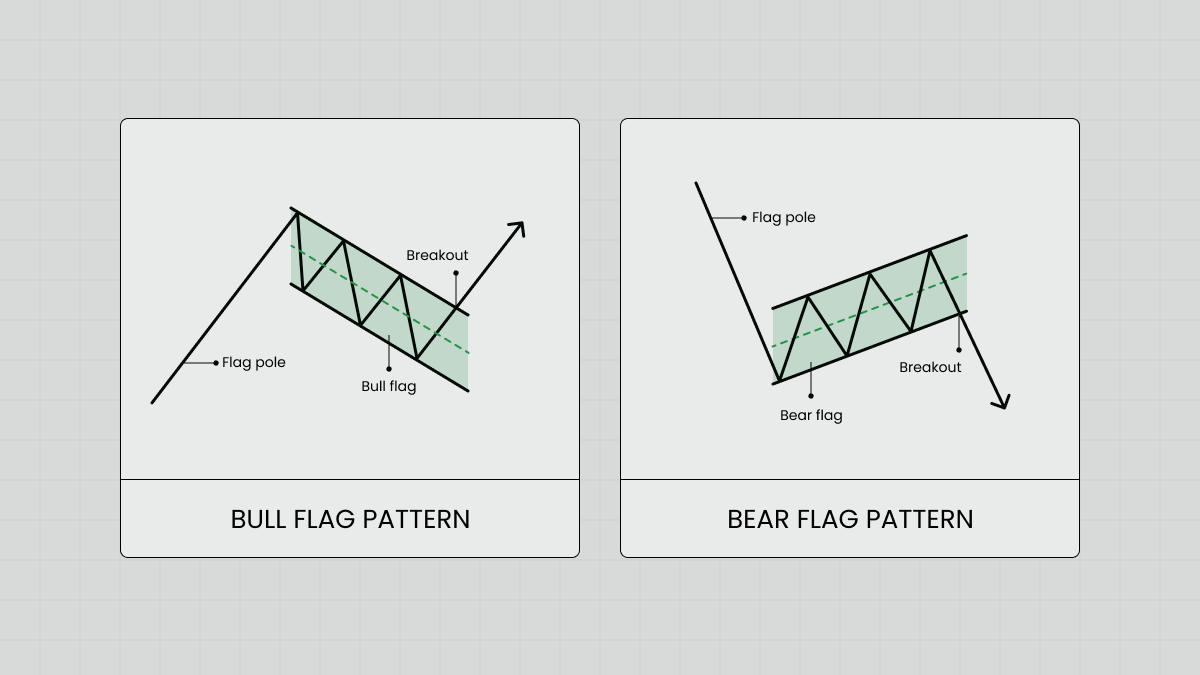

Understanding bullish and bearish flags is essential for traders because these patterns provide insights into market sentiment and potential price movements.

Here are some essential aspects that confirm their significance in trading:

Predictive value

Bullish and bearish flags are highly regarded for their predictive value in indicating the continuation of a trend. Once a breakout identifies and confirms a flag pattern, traders can expect the trend to resume in the direction of the prior strong move. This predictive capability allows traders to position their entries and exits more strategically, potentially leading to higher profitability.

High probability trading

Flag patterns are among the most reliable technical analysis tools. Since they have a high success rate, they are frequently used by both novice and experienced traders to make informed decisions. They are straightforward, which makes them easy to identify and act upon, reducing the ambiguity often associated with other patterns.

Risk management

One significant advantage of the bullish and bearish flags is their contribution to effective risk management. The defined structure of these patterns allows traders to set precise Stop Loss and Take Profit levels. For instance, a Stop Loss can be placed just outside the flag on the opposite side of the breakout, minimizing potential losses if the expected continuation fails to materialize.

Timing market entries and exits

The consolidation phase within a flag pattern offers a relatively low-risk opportunity for traders to enter the market. Since the breakout tends to occur in the initial trend's direction, traders can plan their entries during the flag's formation and execute trades when the price breaks out of the flag.