Follow general guidelines by FBS — they can help anyone, no matter where you are in your investing journey.

Assessing your risk tolerance

Assess your financial situation, define your investment goals, and evaluate your understanding of investments. Consider how comfortable you are with market fluctuations and potential losses. For a specific percentage and valuable insights, consider using online risk assessment tools.

Step 2: Build an emergency fund

Why you need one before investing

An emergency fund is a financial safety net.

It protects your investments, so in case of an emergency like health issues or a job loss you won’t have to sell your assets or withdraw money prematurely.

It helps avoid high-interest debt like credit cards in a situation of unexpected expenses.

It helps reduce stress — knowing you have savings set aside makes you more confident.

How much should you save?

Usually saving from three to six months’ worth of average expenses is optimal. The exact sum depends:

on your job stability (consider saving more if you have irregular income);

dependents (save more if you have family relying on you financially);

insurance (health insurance can reduce the amount needed in your emergency fund);

risk tolerance (aim for saving up to a year’s worth of essential expenses to ensure peace of mind);

current financial conditions (for example, inflation rate).

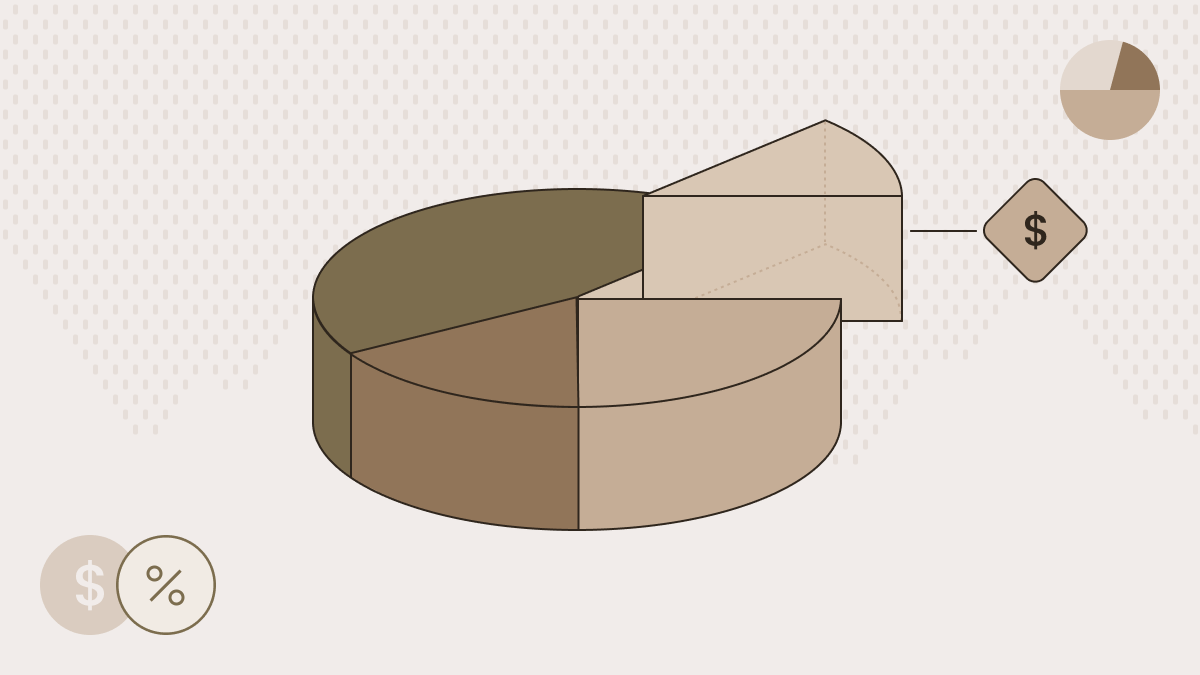

Many financial experts recommend that you invest a specific percentage of your after-tax income — about 10% to 25% of your post-tax earnings. If setting aside that much of your monthly income for investing seems challenging, don’t let that discourage you. Sometimes, even putting aside a small amount can make a difference with the right tools.

Here are a few important factors to consider:

Take a close look at your monthly earnings to see how much you have left after covering essential expenses. If you’re struggling to make ends meet, it may be more beneficial to focus on building an emergency savings fund or paying down debt first.

Managing debt, especially high-interest debt, can be challenging without a solid plan. Assess how much you owe and the interest rates attached to those debts. Figure out how much you can safely invest while still covering at least your minimum payments. As you reduce your debt, revisit your investment contributions and consider increasing them.

An emergency fund is vital for handling unexpected expenses without relying on debt. If you’re still working to save three to six months’ worth of essential expenses, it may be wise to start with a smaller investment amount while you build that financial safety net.

To help you manage your finances going forward, you might consider the 50/30/20 budgeting rule. This approach divides your monthly budget into three categories: 50% for essential needs, 30% for discretionary wants, and the remaining 20% for debt repayment, savings, and investments.

Step 3: Understand different investment options

Once you’ve determined your goals, the next step is to decide what to invest in. Each investment comes with its own risks, so you should understand the details, how much risk you’re comfortable with, and whether that matches your financial objectives. Here are some popular investment choices:

Stocks

Stocks are a piece of ownership in a company (for example, Apple (AAPL), Tesla (TSLA), or Microsoft (MSFT)), also referred to as equities. You buy stocks at a share price, which ranges from just a few dollars to several thousand, depending on the company’s market value. This allows investors to enter the stock market at various levels and makes it accessible for both new and experienced investors.

Stocks are seen as some of the best investments based on past returns, often outperforming other options like bonds.

Mutual funds and ETF

Mutual funds are a curated collection of investments. They allow you to bypass the need to pick individual stocks and bonds and give you a diversified portfolio in one convenient purchase. Some mutual funds have professional managers who make investment decisions. There are also index funds that match the performance of stock market indices, such as the S&P 500, without active management. The downside is that you have less control over the specific investments within the fund.

ETFs are similar to mutual funds in that they bundle together multiple investments. The key difference is that ETFs can be bought and sold throughout the day, just like individual stocks. This often means that ETFs have a lower price point than mutual funds. On the flip side, they’re subject to market volatility throughout the day. Examples of ETFs include the SPDR S&P 500 ETF (SPY), and the Vanguard total stock market ETF (VTI).

Bonds

A bond is a loan you provide to a company or government (for example, U.S. Treasury bonds, corporate or municipal bonds), which agrees to pay you back after a specific period, with interest. Generally, bonds are viewed as less risky than stocks because you know exactly when you’ll get your money back and the interest you’ll earn. However, they can limit your overall growth potential if you’re looking to build wealth over time.

Real estate and alternative investments

You can also invest into real estate or similar assets like REITs (real estate investment trusts). Real estate is good for hedging against inflation and provides stable income.

As for alternative types of investments, you can choose from metals, cryptocurrencies, hedge funds, etc.

Here’s a table that compares different types of assets.

| Stocks | Bonds | ETFs | Mutual funds | Real estate | Alternative types of investments |

Definition | Shares of a company (equities) | A loan to a company or government | Multiple investments traded during the day | Professionally managed investment pools | Physical properties or real estate investment trusts (REITs) | Crypto, commodities, hedge funds, private equity |

Risk level | High | Low to average | Average | Average | Average to high | Depends on the security |

Return potential | High | Low to average | Average to high | Average to high | Average to high | Depends on the security |

Liquidity | High | Average to high | High | Average | Low to average | Depends on the security |

Diversification | Low (unless buying many) | Low | High | High | Moderate | Depends on the security |

Management Style | Self-directed | Self-directed or managed | Passive (index) or active | Actively managed | Self-managed or through funds | Self-managed or managed |

Income Potential | Dividends, capital gains | Fixed interest | Dividends, capital gains | Dividends, capital gains | Rental income, appreciation | Depends on the security (for example, it can be royalties or trading profits) |

Step 4: Choose an investment account

Let’s break down the differences between various types of investment accounts.

Brokerage accounts vs. retirement accounts

When people talk about trading stocks, currencies, or commodities, they’re often referring to using a brokerage account. If you’re 18 or older, you can easily open one of these accounts. You have the freedom to deposit as much money as you want, whenever you want, and you can choose from a wide array of investment options. Plus, you generally have the ability to withdraw cash whenever you need it.

While brokerage accounts are straightforward to set up, they do come with tax implications. You’ll typically need to pay taxes on any realized investment gains each year, including profits from selling investments or receiving dividends.

IRA, or individual retirement account is designed to help save for retirement. There are two types of this account:

roth IRA (contributions are made with after-tax money, but withdrawals in retirement are tax-free);

traditional IRA (contributions may be tax-deductible, but withdrawals in retirement are taxed as income).

Another way to save for retirement is to use a 401(k) — an employer-sponsored retirement plan. Employees contribute a portion of their salary, often with an employer match. Like IRAs, there are:

traditional 401(k) (contributions lower taxable income, but withdrawals in retirement are taxed);

roth 401(k) (contributions are made after tax, and qualified withdrawals are tax-free).

How do you choose the right brokerage account? Check the most important features in the table below.

| Taxable brokerage account | Traditional IRA | Roth IRA | 401(k) | Margin account | Robo-advisor account |

Tax benefits | None; taxed capital gains & dividends | Tax-deferred; taxed withdrawals | Tax-free withdrawals | Tax-deferred; taxed withdrawals | None | None, but some automated tax efficiency |

Contribution limits | No limit | $7,000 ($8,000 if you are older than 50) | $7,000 ($8,000 if if you are older than 50) | $23,000 ($30,500 if you are older than 50) | No limit | Varies by provider |

Withdrawal rules | Anytime, taxed on gains | Before 59½: 10% penalty (exceptions apply) | Contributions anytime; earnings taxed if withdrawn early | Before 59½: 10% penalty (exceptions apply) | Anytime, but interest on borrowed funds applies | Anytime, but automated strategies are long-term focused |

Investment options | Stocks, bonds, ETFs, options, crypto | Stocks, bonds, ETFs, mutual funds | Stocks, bonds, ETFs, mutual funds | Employer-selected funds, sometimes brokerage window | Stocks, bonds, ETFs, options, cryptocurrency | Varies, often ETFs and mutual funds |

Best For | General investing with flexibility | Retirement savings with tax deferral | Tax-free retirement growth | Employer-sponsored retirement savings | Experienced investors using leverage | Investors who want automation |

Step 5: Start with low-cost, diversified investments

The power of dollar-cost averaging

Dollar-cost averaging is a simple and effective investment strategy where you invest a fixed amount of money at regular intervals — like $500 every month — regardless of market conditions. This method helps minimize the stress of trying to time your investments perfectly. By spreading out your purchases, you can reduce the impact of market volatility on your overall investment. Just bear in mind that it can lead to higher transaction costs.

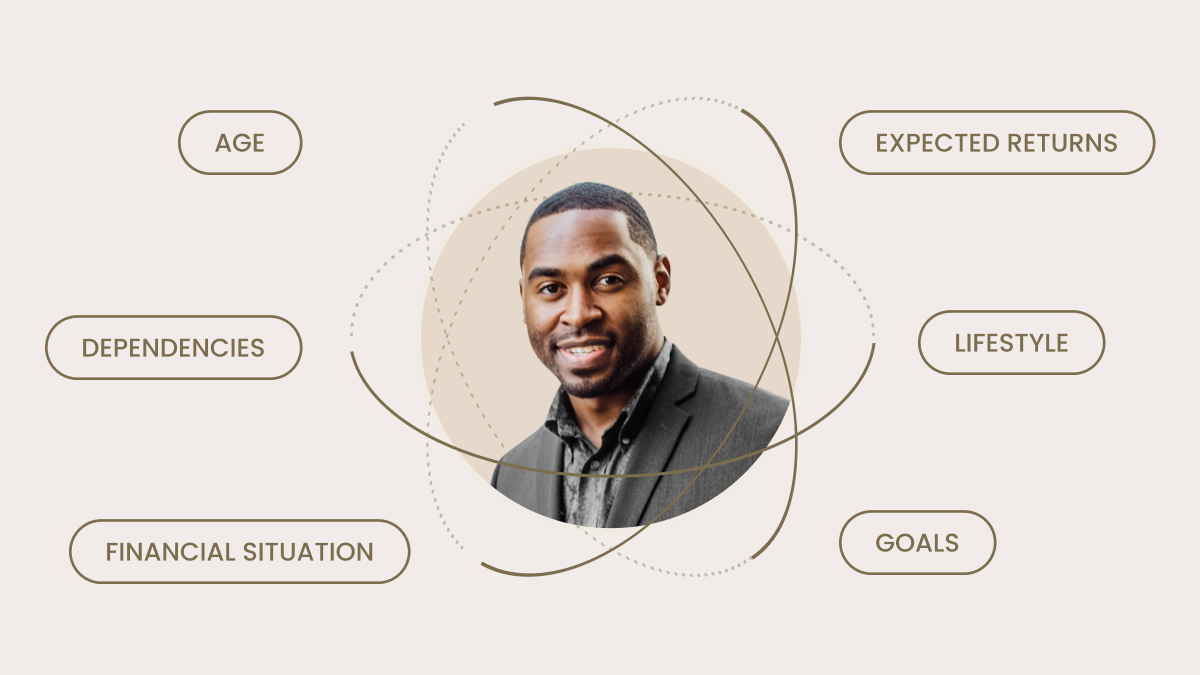

Step 6: Create a simple investment strategy

Your investment strategy should reflect your savings goals, the amount of money you need to achieve those goals, and your timeline for reaching them.

If your savings goal is years away, you can afford to invest most of your funds in stocks. With such a far-off horizon, you have the opportunity to ride out market fluctuations. However, selecting individual stocks can be complex and demanding. For some, investing in indices makes more sense because it offers a way to achieve broad market exposure with lower costs and less complexity.

Conversely, if you’re putting money aside for something in the near future, like a home down payment or a vacation within the next five years, it’s wise to be more cautious. We’ll explore specific strategies designed for different groups later in this article.

Investment strategies

Your investment strategy is your financial roadmap. It outlines what you plan to invest in, how much you’ll invest, and when you anticipate selling those investments.

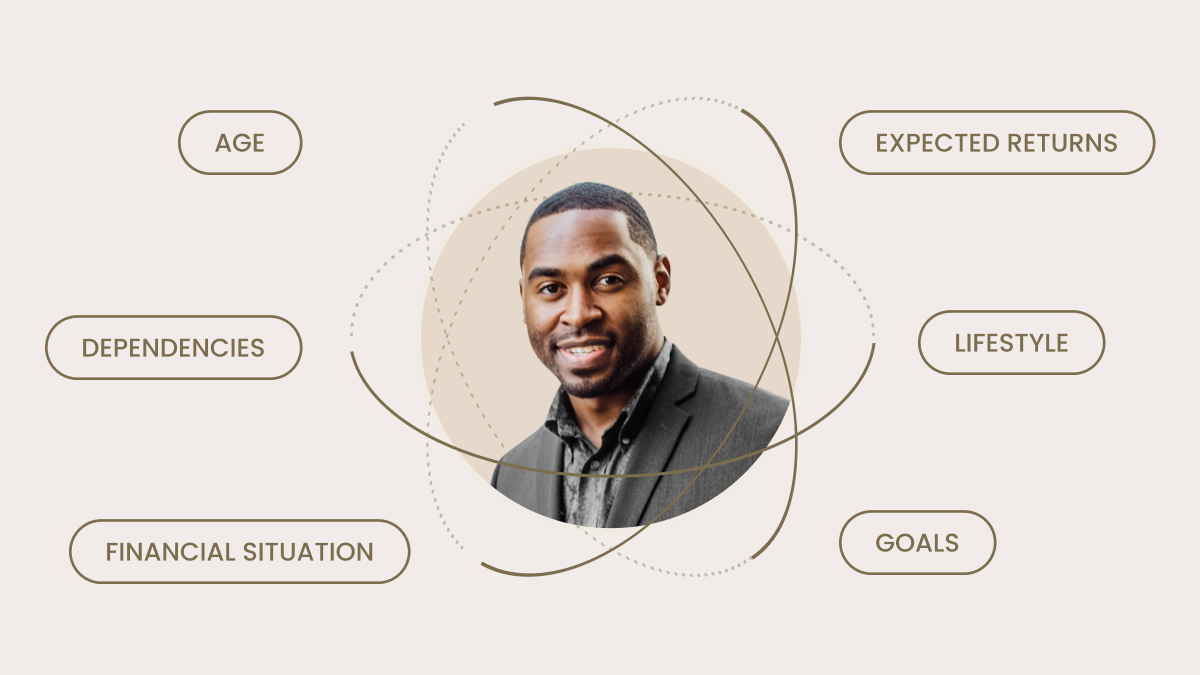

It’s important to note that there isn’t a one-size-fits-all strategy. Each investor has different goals and interests, so determining the right approach for you involves considering several key factors:

Age — Are you leaning toward caution as retirement approaches, or are you more willing to take risks for potential growth as a younger investor?

Dependencies — Do you have family members or children who rely on you financially?

Goals — What are your specific investment goals? Saving for retirement, a home, education, or something else?

Lifestyle — How much disposable income do you want to have while you invest?

Financial situation — How much can you realistically set aside for investments without straining your daily budget?

Expected returns — How long are you willing to wait to see returns on your investments?

With these considerations in mind, let’s explore common investment strategies to guide you toward your financial goals:

Active vs. passive investing

Active investing involves regularly buying and selling assets, like stocks or bonds, in an attempt to outperform the market. This strategy demands a keen eye on market trends and a willingness to make quick decisions. If you enjoy diving into market analysis and want to seize opportunities as they arise, active investing might suit you.

In contrast, passive investing takes a more relaxed approach. Here, you invest in indices or other diversified portfolios that track the overall market. This strategy requires less daily attention and is designed to grow your investments over time with minimal management.