FAQ

Is momentum trading a good strategy?

Momentum trading strategies can be highly effective in volatile markets. However, they also carry risks, as trends can reverse unexpectedly, potentially leading to significant losses.

Momentum-based trading strategies depict a more nuanced approach involving advanced techniques, indicators, and a blend of fundamental and technical analysis. Understanding market signals and timing is crucial for traders employing this strategy. It requires continuous monitoring and swift decision-making to adapt to sudden market changes.

What is the best momentum indicator for Forex?

The Relative Strength Index is widely regarded as one of the most useful momentum indicators for Forex trading. It helps identify overbought or oversold conditions in the market, allowing traders to anticipate potential reversals. Traders often use it with other indicators to confirm trends and optimize entry and exit points.

What is the best momentum time frame?

The optimal momentum time frame can vary depending on market conditions and the specific assets being traded. However, intermediate time frames, ranging from three to 12 months, are often used by momentum traders to balance between capturing significant trends and managing trading risks.

What are the disadvantages of momentum trading?

Momentum trading requires quick decision-making and constant market monitoring. This strategy is also prone to high volatility and can be affected by abrupt market reversals, which might lead profitable trades to losses. Moreover, the fast-paced nature of momentum trading can impose stress on traders, demanding not only quick reflexes but also a high tolerance for risk and fear of missing out. The necessity for continuous attention to market fluctuations means that momentum trading may not be suitable for every trader, particularly for those who cannot dedicate the time to constantly monitor the markets.

Is momentum trading profitable?

Momentum trading can be profitable, especially in markets where trends are strong and clear. However, like any trading strategy, the success of momentum trading strategies depends on proper execution, timing, and risk management. Traders must know how to identify trends and when to exit to maximize gains and minimize losses. Success in momentum trading also hinges on the ability to manage emotions and maintain discipline in following the trading plan.

Emotional trading can lead to mistakes such as holding onto positions for too long and exiting too early based on fear or greed.

Conclusion

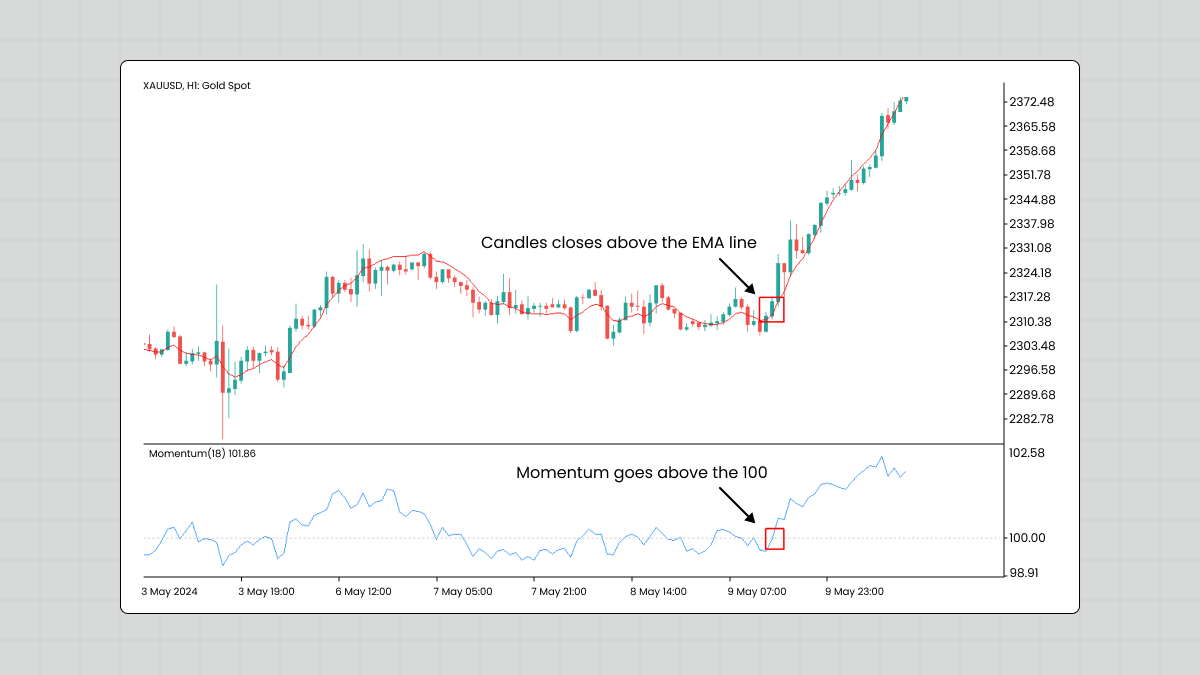

Throughout this article, we’ve uncovered the dynamics that drive a momentum trading strategy. The effectiveness hinges on identifying the right moments to enter and exit the market. This involves a combination of trend analysis, volume assessment, and monitoring market volatility–elements that are crucial in predicting the continuation of price movements. By employing indicators such as the Momentum oscillator, MACD, and RSI, traders can detect early signs of momentum and determine the strength of ongoing trends.

However, the volatile nature of markets means that momentum trading is not without its risks. Rapid price movement can offer substantial rewards, but they also present challenges. The potential for quick reversals requires risk management strategies, including setting stop-loss orders to protect against unexpected market shifts. Moreover, the short-term focus of momentum trading demands constant vigilance and a proactive approach.

In conclusion, momentum trading strategies require an in-depth understanding of market dynamics and sound risk management practices. Traders must be well-versed in technical analysis, attentive to market signals, and disciplined in their trading practices. With these skills, momentum traders can not only capitalize on market opportunities but also navigate the complexities and challenges that come with volatile trading environments. Incorporating effective indicators and adhering to a disciplined trading plan are crucial for increasing the chances of success. Our advice is to continuously refine your strategies based on your performance, practice your strategies on a demo account, and always apply risk management tools.