Is this the final step before you’re ready to trade for real? Who knows, but it will surely make your trading style more organized and prepared for the market’s ups and downs.

Let’s create your strategy!

Is this the final step before you’re ready to trade for real? Who knows, but it will surely make your trading style more organized and prepared for the market’s ups and downs.

Let’s create your strategy!

You've heard the term “strategy” used frequently, but what does it really mean?

A strategy is your navigation system in the trading world. Without one, you’re wandering around, hoping to bump into a good trade. With one, you’re focused on your target. The best part? Strategies are personal—you can mold them to fit your goals, risk tolerance, and trading style.

A strategy is your navigation system in the trading world.

Here’s how to build a basic trading strategy in a few simple steps:

Are you aiming for short-term or long-term trades? Short-term trades (scalping, day trading) aim for smaller, quicker profits; long-term trades (swing, position trading) focus on larger moves and require patience.

Focus on something achievable within a certain time period so later you can track your progress and refine the strategy.

We suggest choosing EURUSD and XAUUSD as your main instruments for the first several months. There is a lot of education and advice available for those two pairs, so it will be easier for you to grow your skills. In addition, these two instruments are considered the main forex trading pairs, and their movements are slightly more predictable.

Example: "I aim for a 2% weekly gain trading EURUSD and USDJPY. I’m not very patient, so I will trade short-term." Having a concrete target helps you stay disciplined and avoid the temptation of making impulsive decisions.

Setting these smaller goals gives you something measurable to work towards, and that’s key for tracking progress. Remember: trading is a marathon, not a sprint.

Now that you’ve defined your goal and chosen your instruments, it’s time to decide on your trading style. One popular approach for beginners is the trend following strategy.

In this strategy, you’re not looking for constant action. Instead, you’re identifying a clear trend (up or down) and following it. Once a trend is established, you open a trade in the same direction and let the price do the rest.

It’s like riding downhill on a bicycle. You can rest while gravity pulls you forward. Just don’t forget about the brakes.

There’s a lot of trading approaches. You can learn about other strategies by opening this article in a separate tab.

Now let’s talk about the tools that help you make smart decisions—indicators. They help you predict the next movement, so don’t hesitate to use at least one.

Trend indicators: Moving averages (MA) or MACD can confirm the direction of the trend. For example, when the price is above MA (see the screenshot below), we consider this an uptrend where you may want to look for buy trades.

Reversal indicators: RSI or Bollinger Bands can signal if prices might reverse. For example, if the price is rising and the RSI is above 70, the price may start falling soon. Note that technical indicators are helping tools and can’t predict the price with 100% accuracy.

These indicators help you time your entries better so you’re not just blindly buying or selling.

Example setup: Add a 20-period moving average and RSI (14) to EURUSD, and enter when the price crosses the 20-MA and RSI is near 50.

Why do you need to do this? The reason is that if you enter randomly, your results will be random as well. Thus, you will be gambling, not trading. And we can say for sure, there are no long-term profits in gambling. Traders take control, and the best way to do that is to define entries and exits for each and every trade.

Entry: Use clear criteria, such as “enter long (buy) if price crosses above the 20-MA with RSI under 50.” We suggest having at least 2 indicators on the chart. In that case, MA tells you the trend direction and the RSI helps you understand whether the price may reverse soon.

Exit: Aim for a 1:2 risk-reward ratio: if risking 100 points, aim for 200 points profit. This is a golden rule for trading, we suggest starting with it. However, as you gain more skill and knowledge, you can change the risk-reward to another one.

Example: Buy EURUSD when the price crosses the 20-MA, and the RSI is near 50. A stop-loss is 100 points below and a take-profit is 200 points above.

Two tips with a little explanation:

Demo trade: Use a demo account to test your strategy and track results.

Review and adjust: If your timing is off, consider adjusting indicators. For example, change your RSI threshold from 50 to 40 to get earlier entries. You need to do this after a series of trades. Start by analyzing your results every 5-10 trades to see what needs to change.

After following all the steps, here’s what you get:

Instrument: EURUSD

Goal: 200-point gain on a short-term trade.

Setup: 20-MA confirms trend; RSI indicates price may continue rising.

Entry: Buy when the price crosses above the 20-MA with RSI around 50.

Exit: Set a stop-loss 100 points below entry and a take-profit 200 points above.

Let’s say EURUSD is going up. You wait for the price to rise through the MA, check the RSI, and enter the trade. Set the stop-loss just 100 points below the entry price, and your take-profit should be 200 points away.

Then, you wait for the trade to result in a stop-loss or a take-profit.

Once you’ve built a strategy, don’t dive in head first with all your money. Use the minimal trade size (or a demo account) to test everything. Open trades based on your strategy and track the results. Was your stop-loss too tight? Did you take profits too early?

Tweaking your strategy is a natural part of the process. We have tested hundreds of strategies and approaches before, and we know how important (and interesting) it is to find the one that suits you.

And remember, no strategy is set in stone. The market changes, and so should your approach. Stay flexible!

Creating a strategy may take a lot of time, and even if it goes well, your first trades may bring uncertainty. You may ask yourself, “How can I get more information about the market so I can trade better?”

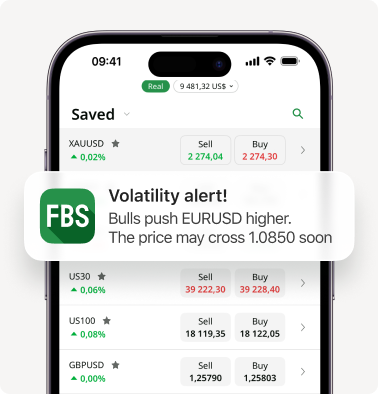

First, you can (and should) turn on the notifications in the FBS app. Our team works every day to bring you special push notifications with the freshest information about price movements and important news. It’s way easier than searching for events and looking through a hundred charts every day. Save yourself some time.

Second, we introduce FBS AI Assistant — a powerful tool designed to make your trading experience smoother and more informed.

The feature automates technical analysis, providing comprehensive reports on trends and patterns in just seconds.

How to use FBS AI Assistant:

Open the FBS app.

Select your instrument and time frame. For optimal results, we recommend setting the time frame to at least 15 minutes.

Add at least two indicators. It helps to generate a better report.

Click the icon.

Place an order. After reviewing the analysis, you can instantly place an order based on the AI-generated strategy. Please note that this AI is a helping tool and it can’t predict the price with 100% accuracy.

Ah, the sweet moment of cashing out—there’s nothing like seeing your profits turn into real money. But let’s talk about when you should withdraw. Spoiler alert: it's not every time you make a dollar.

Here are a few signs it’s the right time to withdraw:

You’ve met a financial goal

If your goal was to turn $500 into $1000 and you’ve done it, congrats! This might be a great time to cash out some of that hard-earned money. Setting specific financial goals makes it easier to know when to hit Withdraw.

You want to reinvest in a new opportunity

Sometimes withdrawing your profits is not about taking money out of the market—it’s about putting it into something new. Let’s say you’ve been trading forex pairs for a while and you now want to try buying and storing physical gold at your home. Taking some profit out and using it to diversify into another asset can be a smart move.

Your trading account grew too large

Sounds like a good problem, right? Well, sometimes it’s smart to withdraw profits to keep your trading deposit the same. For example, if you started with $1000 and your account is now $10 000, you might want to withdraw some profits so you can continue trading on the initial $1000 and not tempt yourself to open a too-big trade.

You need the money

This one’s obvious. If you need the funds for something important in your personal life, don’t hesitate to take it out. The whole point of trading is to improve your financial situation, not to keep all your money locked up forever.

Remember, there’s no one-size-fits-all answer here. Some traders withdraw profits monthly like a paycheck, while others let them grow for longer periods. We recommend taking out some of your monthly profits, even if it’s just $10. Feeling the profits in your hands is very important to stay emotionally motivated.

And there you have it—you've gone through your final lesson! By now you should feel confident in managing risk, creating strategies, and executing trades. Trading is a marathon, not a sprint, so keep learning, stay patient, and watch your skills—and account—grow over time.

Trading is a marathon, not a sprint.

It’s time for your first real trade! Here’s your mission:

Deposit an amount you feel comfortable with—something that won’t keep you up at night if the trade doesn’t go as planned.

Open a real trade and apply everything you’ve learned—set a stop-loss and take-profit just like a pro.

Check back on your trade the next day and see how it went. Did your stop-loss save you from a bigger loss, or did your take-profit lock in some sweet gains?

Finally, once you’ve made some profit, try out the withdrawal feature and see how easy it is to access your money. It’s all part of the trading experience!

Share your feedback on the course by leaving a review. This helps us improve and supports other learners!

Arkadaşlarla paylaş: